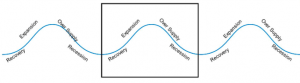

Real Estate values across the country move in a continuing economic cycle. The key to successful real estate investing or purchasing is understanding the general principles of the economic cycle. There are 4 pieces that make up the real estate cycle – Recovery, Expansion, Over Supply, Recession.

Similar to running Mt. Pisgah, to get to the top, there is a slow incline, some level parts, and a very steep incline. As they say, what goes up must go down, so the natural process is a decent back to where the path started.

RECOVERY – represents the slow leveled out portion of the cycle.

Towards the end of recovery, increasingly a steeper incline appears.

EXPANSION – represents that incline. This cycle takes us to top of the mountain, where we feel as if we were the king of the world.

OVER SUPPLY – represents the start of the decline process. The period where the real estate market becomes saturated and some would argue the period where it starts getting tough to sale.

RECESSION – represents the tough times where it is hard to buy or sell. Asheville’s real estate market has left the recession phase.

Many of the counties surrounding Asheville may still be in the recovery cycle. With Asheville real estate and Buncombe County real estate a hot commodity, many would consider this the end of recovery into expansion phase.

Each period of the cycle does not have a timeline. A complete cycle often lasts 10-15 years, with 7 years being very strong for the market. Many things contribute to supply and demand in real estate, especially catastrophic events and financial market blunders. Speak with your real estate buyer’s agent to understand in depth what period you are buying in and what questions to ask.